This investment opportunity is closed and no longer taking new investments.

Please join our Investor club to stay up to date on new offerings.

Syndicated Investment Opportunity

35 Luxury Townhome Rentals in Oklahoma

Watch the Webinar

Jeremy Wetmore and Adam Schweickert take you through Twenty Five Capital’s latest syndicated opportunity in Broken Arrow, Oklahoma.

Schedule a Call to Discuss

The below will take you to our availability to discuss the offering.

If you do not have a pre existing relationship with Twenty Five Capital, we require an introductory call to determine if we’re a fit to work together.

A pre existing relationship exists if we’ve had a direct conversation with you about your investment goals, objectives and have determined we’re a fit to work together.

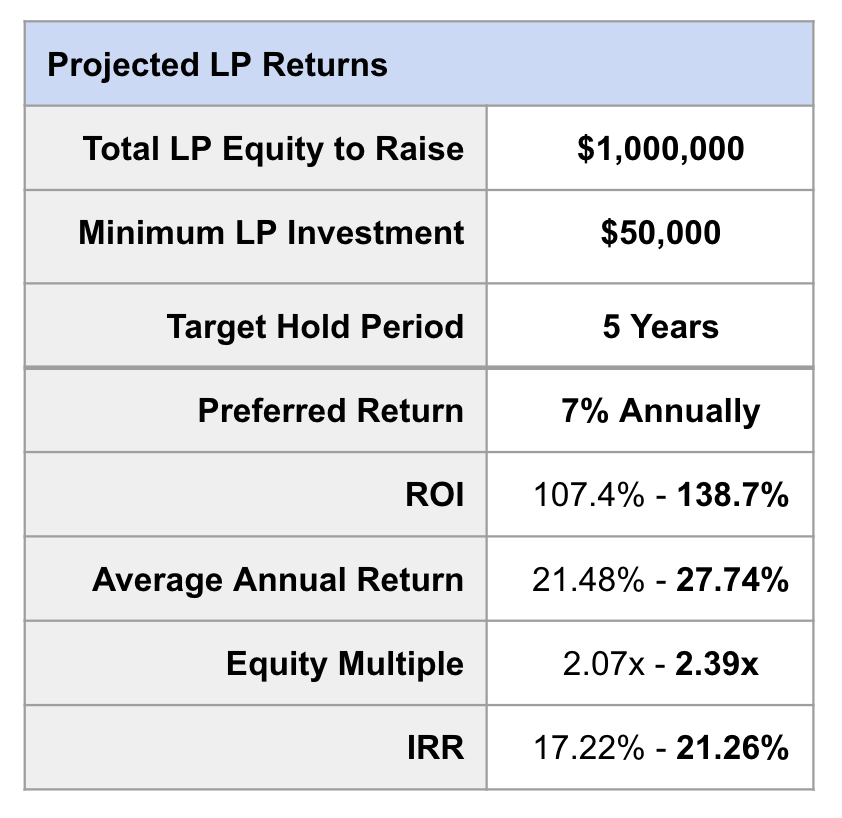

Projected Returns

Timeline to Invest

Material to Review

How to Invest

#1 - Sign Up for our Investor Club

This is where all communication around our investment offerings will be provided moving forward. Once you sign up, we will reach out for an intro call if we have not spoken before.

Even if you do not plan to participate in this offering, we highly recommend getting our our list to stay up to date for future offerings.

#2 - Place a Reservation (Soft Commitment)

Reservations are placed within your Investor Portal.

Please note, we are only working with sophisticated and accredited investors on this opportunity through a 506(b) Private Placement. Please consult your professional advisors before making any investment decision.

#3 - Review & Sign the Private Placement Memorandum

The PPM will soon be available for your review. We will notify prospective investors once available.

This document contains the fine print of the offering and operational details. Please do not make an investment decision without thoroughly reviewing the PPM. Signing the PPM is your commitment to participate in the offering.

#4 - Wire Funds on Funds Due Date

Investors who have signed the PPM will be notified ahead of time and provided detailed wiring instructions, which will walk you through the process to wire funds.

#5 - Collect Passive Income

Distributions will be paid out on a quarterly basis when the property is producing profits.

Please review the Offering Memorandum and PPM for a detailed description around distributions and when they will be paid.

Disclosures

The Memorandum contains forward-looking statements. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of the to be formed LLC, (the “Company”) business and the 35 “Class A” Rental Townhomes in Broken Arrow, Oklahoma, (the “Project”), future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Forward-looking statements can be identified by words such as: “will,” “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” and similar references to future periods.

Examples of forward-looking statements include, among others, statements made regarding:

Expected terms and timing of closing on construction financing.

Expected timeline and costs for completion of the development of the Project.

Expected operating results, including estimated monthly rents, occupancy rates, and cash flow from the Project.

Other plans and objectives relating to the future economic performance of the Company and the Project.

Implementation of the Project investment strategies and business plan, including the strategy for leasing, market position, financial results and reserves, and any future sale of the Project.

Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements, including our projections. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the risks described in this document. An investment in the membership interests of the Company involves a very high degree of risk. Such an investment is suitable only for accredited investors who possess substantial financial means and who have no need for liquidity in this investment. An investment should not be made by any person who cannot afford the loss of his, her or its entire investment.

Prospective investors should carefully read these Risk Factors, along with the Company’s other investment materials, and carefully consider the impact of the following factors, among others. The factors listed below provide examples of risks, uncertainties and events that may cause the actual results to differ materially from the expectations the Company describes in the pro forma projections, financial and other information regarding the development, financing, construction and operation of the Project. While these are the factors the Company believes are the most important to consider, they are not the only risks facing the Company, and the Project.

This opportunity is being offered through a 506(b) Private Placement and is only available to sophisticated and accredited investors.

Please consult your independent professional advisors and review the PPM in detail before making a decision to invest. None of the information listed is financial advice.